franklin county ohio sales tax rate 2020

The latest sales tax rate for Franklin Furnace OH. Lower sales tax than 82 of Ohio localities 1 lower than the maximum sales tax in OH The 7 sales tax rate in Franklin.

Franklin County Property Tax Bills Late Deadline Extended To Jan 31

The December 2020 total local sales tax rate was also 7500.

. Amounts due will include an administrative fee that increases from 12500 when initial notification is sent to 25000 total when certified mail is initiated and then 35000 plus 6. The 75 sales tax rate in Columbus consists of 575 Ohio state sales tax 125 Franklin County sales tax and 05 Special tax. The City of Rossford in Wood County assesses transit rate of 050 in addition to the posted state and county sales tax rate.

A A A. The 2018 United States Supreme Court decision in. DEPARTMENT OF TAXATION.

The state sales tax rate in Ohio is 5750. PAGE 1 REVISED October 1 2020. Delinquent tax refers to a tax that is unpaid after the payment due date.

There are a total of 578 local tax. 2020 tax rate information Tax Year. This is the total of state and county sales tax rates.

With local taxes the total sales tax rate is between 6500 and 8000. 2020 rates included for use while preparing your income tax deduction. Amounts due will include an administrative fee that increases from 12500 when initial notification is sent to 25000 total when certified mail is initiated and then 35000 plus 6.

Office of Diversity Equity Inclusion ODEI Franklin County Data Center Disclaimer. The sales tax jurisdiction. Franklin OH Sales Tax Rate Franklin OH Sales Tax Rate The current total local sales tax rate in Franklin OH is 7000.

Unclaimed Funds Search. State and Permissive Sales Tax Rates by County April 2022. FISCAL FRAN Tax Rate Information Tax-Rate-2020.

COLUMBUS OH 43216-0530. What is Ohio sales tax rate 2020. Unclaimed Funds FAQ.

This rate includes any state county city and local sales taxes. This is the total of state and county sales tax rates. The Ohio state sales tax rate is currently.

The December 2020 total local sales tax rate was also 7000. City of Columbus and Franklin County Facilities Authority Hotel-Motel Excise Tax. The minimum combined 2022 sales tax rate for Medina County Ohio is.

How much is sales tax on a. The following list of Ohio post offices shows the total county. The Franklin County Sales Tax is 125 A county-wide sales tax rate of 125 is applicable to localities in Franklin County in addition to the 575 Ohio sales tax.

A Franklin County property or view your tax bill. The Franklin County sales tax rate is. STATE OF OHIO.

Melissa gilbert children x x. If you need access to a database of all Ohio local sales tax. 7255 Ohio has state sales tax of 575 and allows local governments to collect a local option sales tax of up to 225.

Some cities and local. How does the Franklin sales tax compare to the rest of OH. 575 Average Sales Tax With Local.

Franklin County OH Sales Tax Rate The current total local sales tax rate in Franklin County OH is 7500. Click any locality for a full breakdown of local property taxes or visit our Ohio sales tax calculator to lookup local rates by zip code. There is no applicable city tax.

Reno gazette journal delivery issues refrigerator with french doors. There were no sales and use tax county rate changes effective July 1 2022 2nd Quarter effective April 1 2022 - June 30 2022 Rates listed by county and transit authority. The tax rate was increased to 4 effective September 1 1980 and to.

The Ohio state sales tax rate is currently.

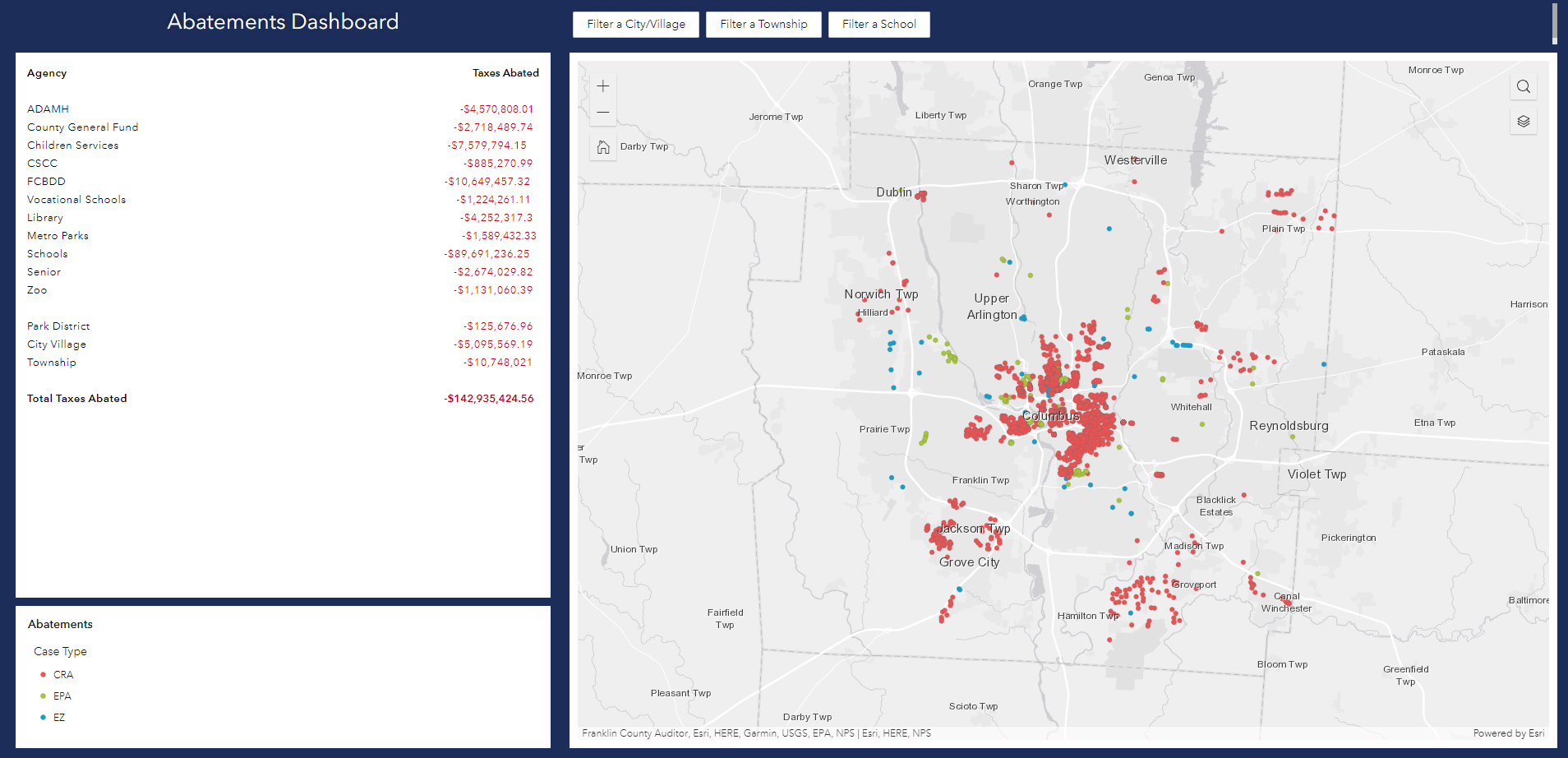

Abatements Franklin County Tax Incentives

Sales Taxes In The United States Wikipedia

Franklin County Treasurer Home

Ohio Tax Rates Rankings Ohio State Taxes Tax Foundation

News From Geauga Portage Lake Counties And Townships

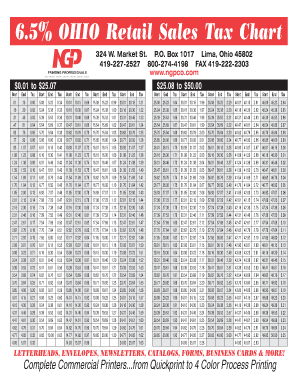

Sales Tax Chart Fill Online Printable Fillable Blank Pdffiller

After Sweeping Municipal Income Tax Rate Increases Across Ohio Where Does Your City Or Village Rank Cleveland Com

What County Is Columbus Ohio In A Look At The City S Geography Nbc4 Wcmh Tv

Ohio Income Tax Calculator Smartasset

Ohio Sales Tax Small Business Guide Truic

Franklin County Treasurer Home

Haves And Have Nots County Property Taxes Provided 2 5 Billion In Local Health And Social Service Funding But It Was Unevenly Distributed The Center For Community Solutions

North Carolina Tax Rates Rankings Nc State Taxes Tax Foundation